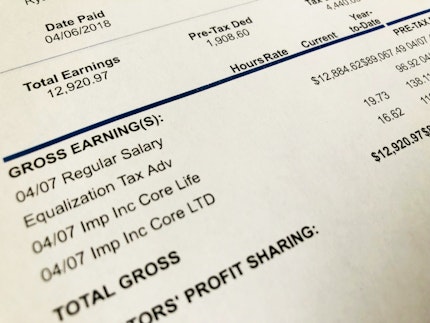

Why You Should Always Check Your Paycheck

Every working American receives a paycheck, and you probably don’t give it much thought before depositing it into your bank account. In fact, you might not even think about depositing it thanks to direct deposit. However, it’s important to check your paycheck and make sure your employer is withholding the right taxes every time. While you might be thinking, “Nothing ever changes, and my paycheck stays the same, so I don’t need to check it,” you should think about all the life changes that could potentially alter your check.