Self-service payroll with the best price for your small business.

An easy payroll solution

Run your payroll with PaycheckCity Payroll. Print checks and file taxes yourself.

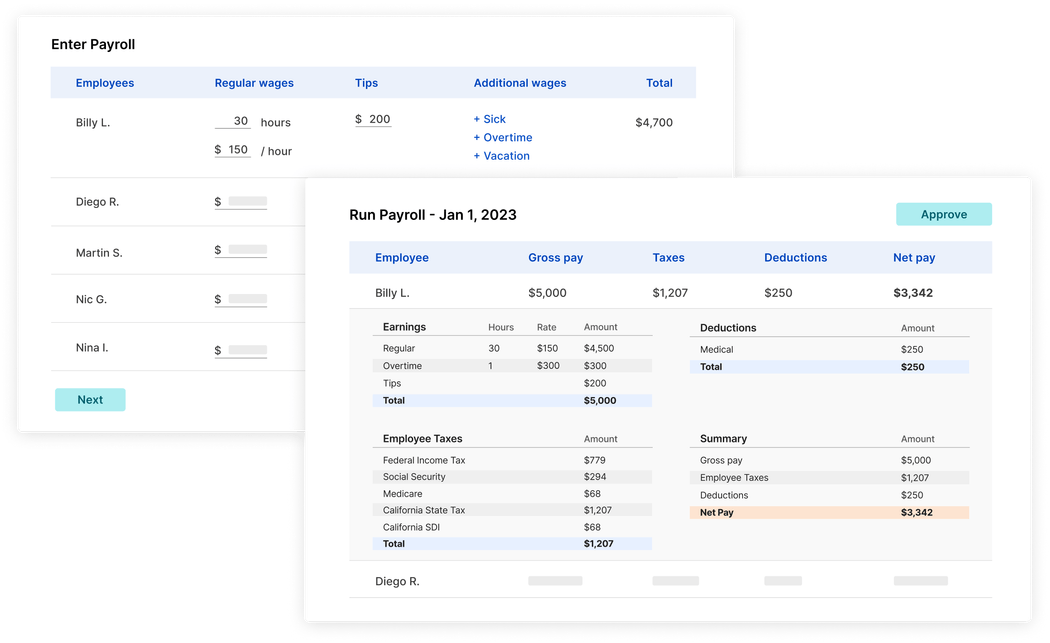

Enter pay details and run payroll.

Input pay information: hours, tips, sick, or vacation time.

We calculate the taxes, you handle the rest.

Your paychecks and paystubs are calculated, populated, and ready for printing.

We’ll tee you up for tax time.

We provide the Federal W-2, 940 and 941 data for you to populate and file.

NEW! Get tax change notifications.

Payroll tax change in your jurisdiction? You’ll hear it from us first!

PaycheckCity Payroll has made us more productive and has saved hundreds of hours of time when running our payroll. They make it simple and easy. We wouldn’t use any other payroll solution and recommend them to any small business owner.

Run your first payroll in just 10 minutes

All you need are a few basic details to get started today!

Step 1

Enter your company name and address.

Step 2

Add an employee’s name, home address, and wage info.

Step 3

Run a payroll and see the tax results.

Step 4

Print the employee’s check or earnings record.

What we do, what you do

If you have any further questions, send us a message through the chat box in the bottom right of the page.

Everything is included in one simple plan

Get all the features in one pricing plan designed with your growing business in mind.

Start your 14-day FREE trial — explore all features with no commitment.

After the trial, continue for just$19 / month(billed as one annual payment of $228)

Create your company, add your employees, and run payroll in just minutes.

You’ll get an email reminder that your trial is ending.

Trial ends, $228 annual rate begins. Cancel anytime before.