How Many Working Days Are In A Year?

In the U.S., the average amount of working days in one year is 260.

Tax Day is on Monday, Apr 15, 2024. Not ready to file? Submit an electronic request to the IRS for an extension ASAP!

This year, for most American taxpayers Tax Day is Monday April 15, 2024. Residents of Massachusetts and Maine have until April 17, 2024 to file their taxes, in observance of state holidays.

If you missed filing taxes by Tax Day on April 15, make sure you know what to do next!

Everyone who asks gets a free automatic deadline extension, but you need to submit some paperwork first. The easiest way is to submit the request to the IRS through their electronic form by April 15 to avoid penalty fees. Electronically filing this form will pause the penalty fees accruing on your account and extend your tax filing due date to October 15, 2023.

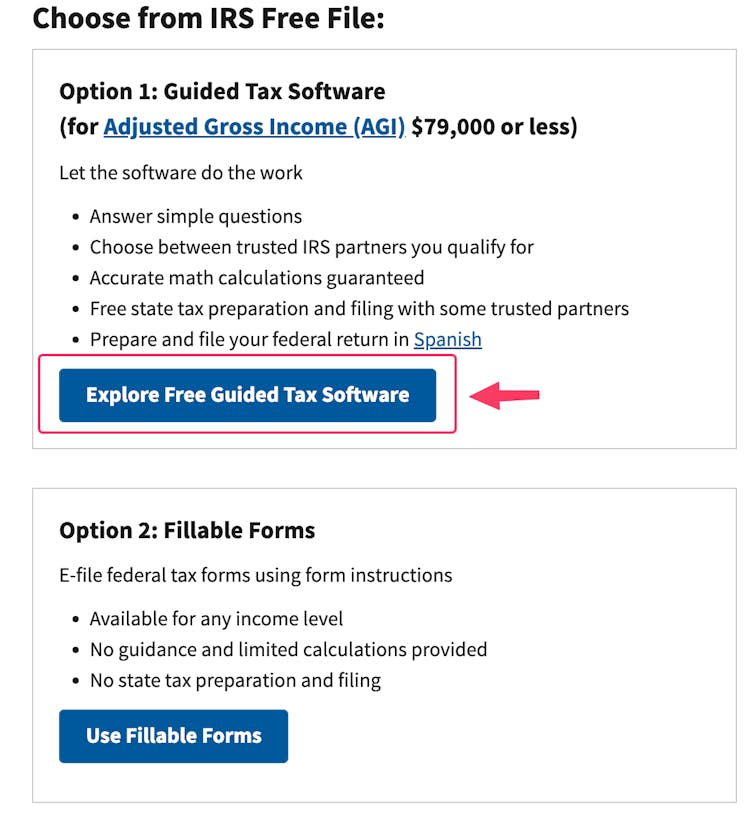

Even if your earned more than $79,000 last year, you can still use the Free Guided Tax Preparation to submit for the deadline extension electronically.

Alternatively you can fill out Form 4868 and mail it in.

If you might owe federal taxes try to not delay any longer. After Monday April 15, 2024 interest with start accruing towards unpaid taxes. The deadline extension only pauses the penalty fees, not interest on taxes owed.

The sooner you file your taxes and pay what's due, including the fees and interest, the less you will have to pay if you keep waiting!

Use the free PaycheckCity Salary and Hourly calculators to find how much federal, state, and local taxes you owe per paycheck.

In the U.S., the average amount of working days in one year is 260.

Making mistakes is a part of starting a business, but knowing what mistakes to avoid will help small business owners in their long-term journey to success. Here are four mistakes small business owners should avoid.

Celebrate National Payroll Week 2024, September 2-6! Join the fun, take the survey for a chance to win big, and honor payroll pros. Discover the joy of getting paid and learn more about this year’s theme: "America Works Because We’re Working for America ®."