Tax Day 2024 and How to Get an Extension from the IRS

Tax Day is on Monday, Apr 15, 2024. Not ready to file? Submit an electronic request to the IRS for an extension ASAP!

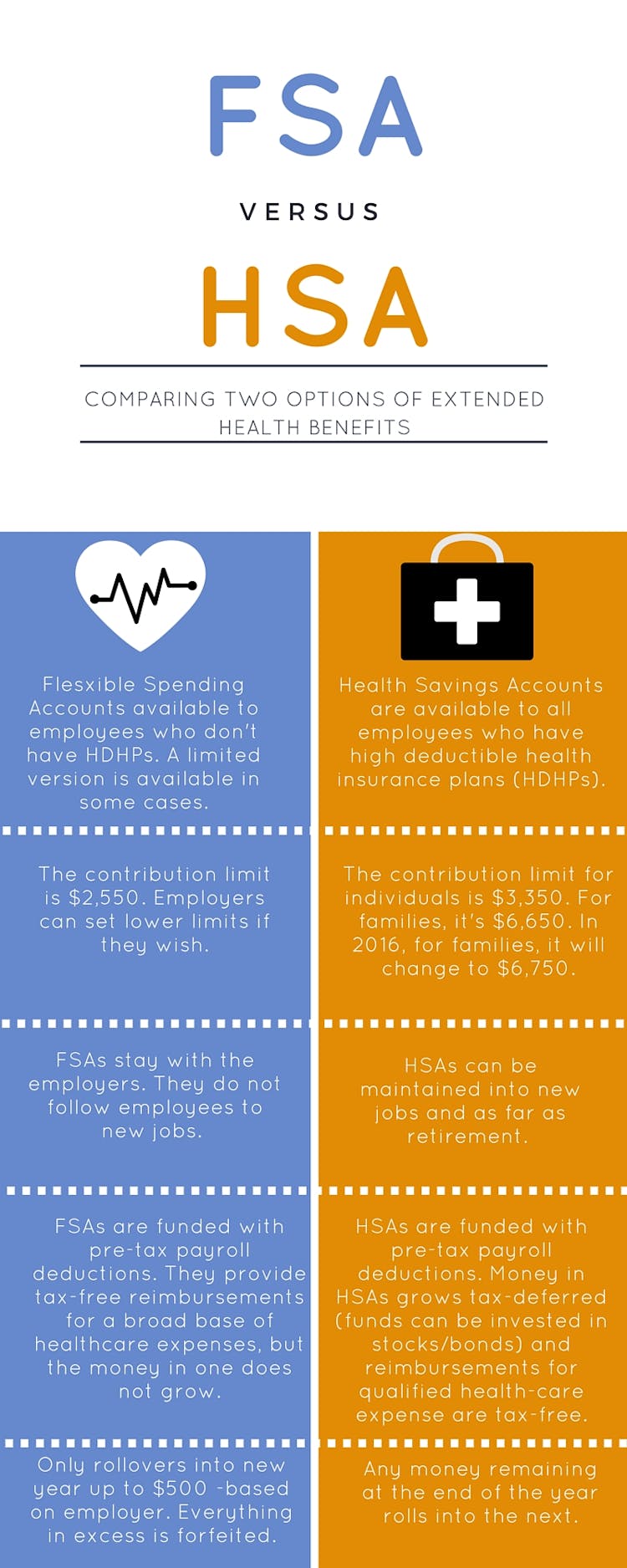

You've heard the terms Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs). Both are two options employers use their employees' tax-free dollars to manage healthcare costs. What do each offer?

Open enrollment is here, and there's a high chance you can't escape the chatter of benefits - whether it be from coworkers or your employer. You might be considering making changes to maximize your healthcare benefits; you may not. However, you've likely heard the terms Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs). Both are options employers have to use their employees' tax-free dollars to manage healthcare costs.

FSAs and HSAs help employees and employers save on taxes, and are easy implementable and cost-efficient. Neither require changes to how an employee currently utilizes his or her benefits. And while an employee can't enroll in the two simultaneously, an employer has the choice to offer both. So what's the main difference and which should you pick given the option? Here's a breakdown:

Tax Day is on Monday, Apr 15, 2024. Not ready to file? Submit an electronic request to the IRS for an extension ASAP!

IRS has updated tax brackets for 2024. See how this affects your first paycheck this year!

Check out the updated 2024 Federal benefit limits for 401(k), HSA, and simple IRA, and more. Stay informed and plan your finances with confidence!