How Many Working Days Are In A Year?

In the U.S., the average amount of working days in one year is 260.

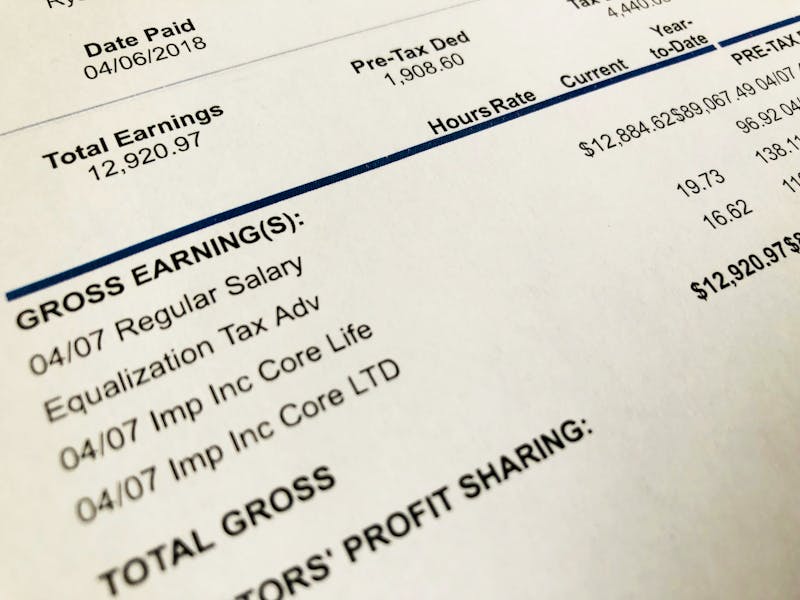

There is nothing like payday. But do you know where your hard-earned dollars are going? Your pay stub provides the answer.

Pay stubs are given to employees with each paycheck they receive. It is a breakdown of the money you have earned and shows how much has been withheld or deducted. Let's dive into the basics of your pay stub.

Most pay stubs have employee and company information located at the top. The company information section has the company name and address, while employee information contains the employee's name, resident address, and social security number. Some pay stubs may have the pay period listed as well.

The employee earnings section shows you your hourly rate and hours worked for the given pay period. If you are a salaried employee, your hours may default to 40 hours per week. The employee earnings section also contains bonuses, commissions, or overtime for the pay period.

Remember, this is your gross income, or the amount of money earned before taxes, contributions, and deductions.

What Is the Difference between Gross and Net Income?

This section shows the breakdown of taxes your employer withholds based off your W-4. These include taxes that we all are familiar with, like social security, federal income tax, and Medicare.

Employer taxes do not affect your net earnings. This section illustrates the tax burden of your employer. Employers must withhold your taxes, and also contribute to social security and Medicare.

This section is where you will see the deductions you have set up, such as medical, dental, and retirement. These deductions will be withdrawn from your gross earnings and not taxed.

Depending on the scenario, some employers will contribute to employee benefits. If so, you will find their contributions in this section.

The summary section of your pay stub shows you the gross earnings, deductions, taxes, net earnings, and any other information regarding your pay stub. The summary section is a great way to get a quick understanding of your earnings for the pay period.

The pay stub can be a confusing aspect of getting paid, but it doesn't have to be. To avoid being overwhelmed, break down the different sections individually. Understand the pay stub is simply a flow chart of your salary: some money will be withheld by your employer, some will be deducted for things like medical and dental insurance, and some will be left over for your take-home pay.

To create paystubs for your employees, try PaycheckCity Payroll.

In the U.S., the average amount of working days in one year is 260.

Making mistakes is a part of starting a business, but knowing what mistakes to avoid will help small business owners in their long-term journey to success. Here are four mistakes small business owners should avoid.

Celebrate National Payroll Week 2024, September 2-6! Join the fun, take the survey for a chance to win big, and honor payroll pros. Discover the joy of getting paid and learn more about this year’s theme: "America Works Because We’re Working for America ®."