Tax Day 2024 and How to Get an Extension from the IRS

Tax Day is on Monday, Apr 15, 2024. Not ready to file? Submit an electronic request to the IRS for an extension ASAP!

Easy step-by-step instructions to manually calculate your paycheck's federal income tax, Social Security tax, and Medicare tax with examples.

There are 3 federal taxes that U.S. employees pay with every paycheck:

Employers must withhold these payments from each W-4 employee's paycheck. These taxes pay for federal expenses like the military, infrastructure, education, health and social programs, and more.

Below are the steps to calculate your federal taxes by hand followed by examples — or you can simply use the free PaycheckCity calculators to do the math for you.

Before you begin, you will need: your paycheck, W-4 form, and a calculator.

Done! This is the paycheck's federal withholding amount. Double-check your result with an online paycheck calculator.

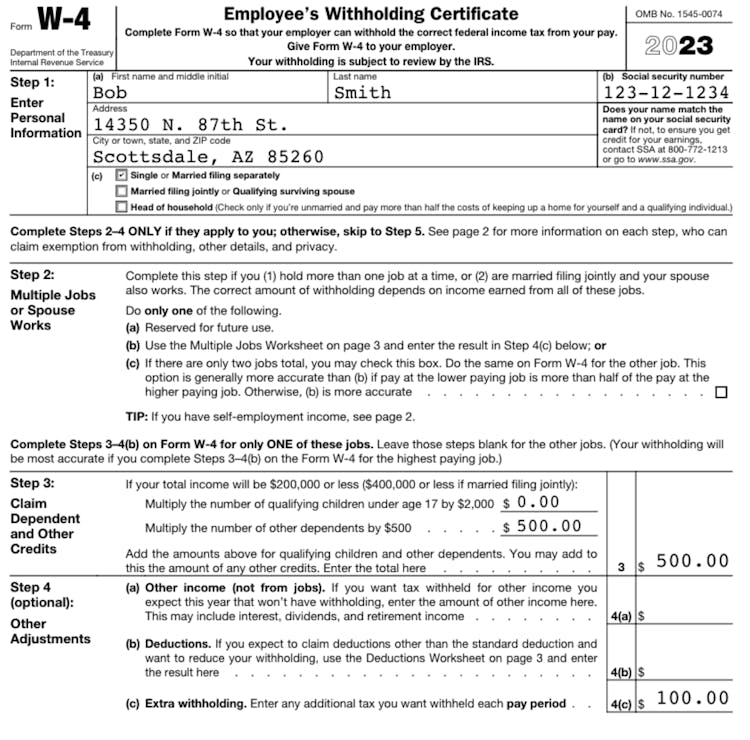

Bob Smith completed a Form W-4 as shown below. In 2023, he is paid $1,100 on the 1st and 15th of each month.

1. Find the paycheck's gross pay (earnings before taxes).

$1,100

2. Determine the number of payroll periods in a year.

Semi-monthly = 24

3. Multiply the wages in Step 1 by the number of payroll periods in Step 2.

$1,100 x 24 = $26,400

4. Take the amount from Step 4(a) of Form W-4 (additional income not from jobs; dividends, retirement, etc.) and add it to the wages from Step 3.

$0 + $26,400 = $26,400

5. Write down the amount from Step 4(b) of Form W-4.

$0

6. If Step 2 box of Form W-4 is not checked: write down $12,900 if married filing jointly, or $8,600 for all others.

$8,600

7. Add Step 5 + Step 6. Subtract this total from the wages in Step 4.

$26,400 - $8,600 = $17,800

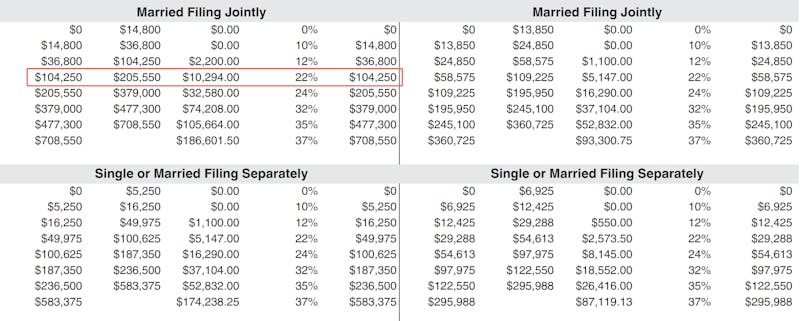

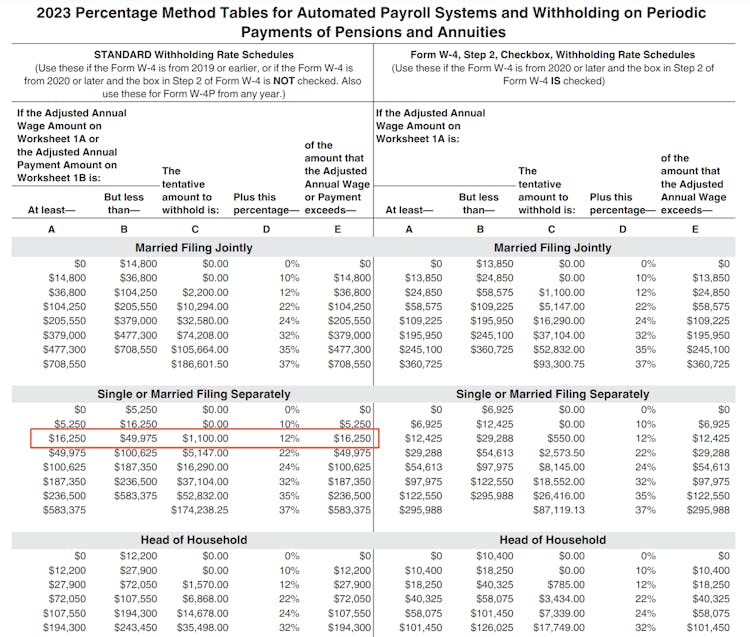

8. Go to the tables on page 11 of the IRS Publication 15T:

Step 2 box of Form W-4 is not checked, so we will use the table on the right.

9. Locate the correct table based on the filing status and on whether the box in Step 2 on Form W-4 was checked.

10. Using the amount from Step 7, locate the range and then work that line from the right side of the table to the left to determine the tentative amount of federal income tax to withhold.

$17,800 - $16,250 = $1,550 x .12 = $186 + $1,100 = $1,286

11. Divide the tax amount in Step 10 by the number of payroll periods from Step 2.

$1,286 ÷ 24 = $53.58

12. Account for any credits – Take the amount from Step 3 of Form W-4, divide it by the number of payroll periods from Step 2 and subtract it from the tax amount in Step 11.

$500 ÷ 24 = $20.83

$53.58 - $20.83 = $32.75

13. Add any additional withholding from Step 4(c) of Form W-4.

$32.75 + $100 = $132.75

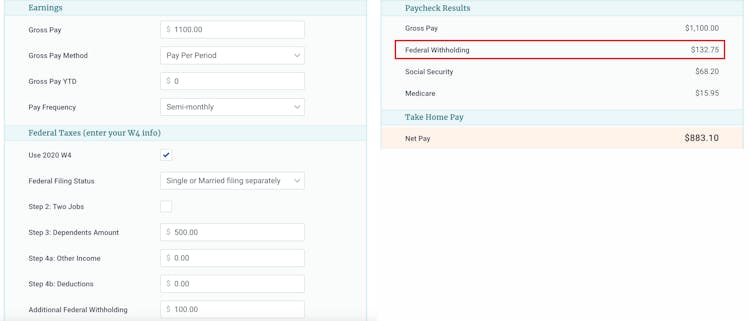

Bob's federal withholding for this paycheck is $132.75. We can double-check our result with a salary calculator:

Not all paychecks end up subject to federal income tax. The federal income tax might result in $0 if the calculation's gross pay and deductions resulted in an annual pay that is less than the standard deduction. The standard deduction is a fixed amount that IRS deducts from everyone's federal income tax each year. It's updated every year to account for inflation.

The standard deduction for 2023 is:

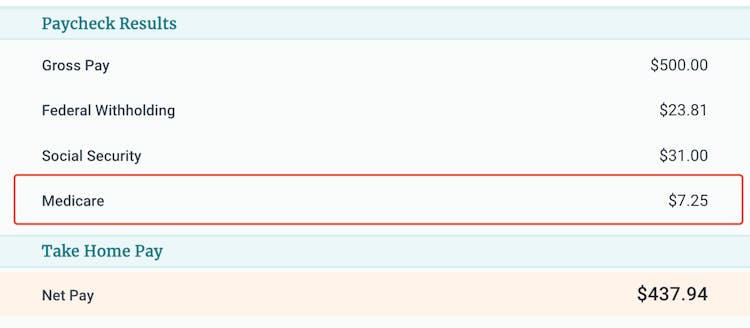

The Medicare tax rate is 1.45% for all employees.

To calculate your Medicare tax amount, simply multiply:

paycheck gross pay * .0145

For example, if a paycheck's gross pay is $500:

500 * .0145 = $7.25

If your year-to-date income has surpassed $200,000, you're subject to the Additional Medicare Tax which is an extra .9% to your tax: paycheck gross pay * .0235.

PaycheckCity Salary Calculator results

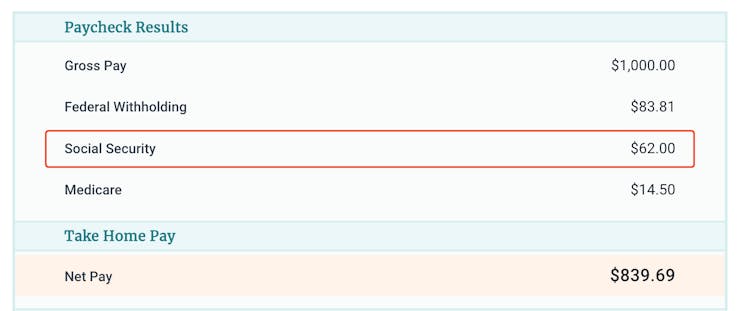

Social Security tax is 6.2% on $147,000 of earned income. The maximum Social Security tax for employees is $9,114 per year.

To calculate your Social Security tax amount, simply multiply:

paycheck gross pay * .062

For example, if a paycheck's gross pay is $1,000:

1000 * .062 = $62.00

PaycheckCity Hourly Calculator results

In addition to federal taxes, employees may be subject to state and local taxes.

And the employer? Employers have to pay other federal, state and local taxes for each of their employees. To calculate employer taxes, use PaycheckCity Payroll.

Happy calculating!

Tax Day is on Monday, Apr 15, 2024. Not ready to file? Submit an electronic request to the IRS for an extension ASAP!

IRS has updated tax brackets for 2024. See how this affects your first paycheck this year!

Check out the updated 2024 Federal benefit limits for 401(k), HSA, and simple IRA, and more. Stay informed and plan your finances with confidence!