Tax Day 2024 and How to Get an Extension from the IRS

Tax Day is on Monday, Apr 15, 2024. Not ready to file? Submit an electronic request to the IRS for an extension ASAP!

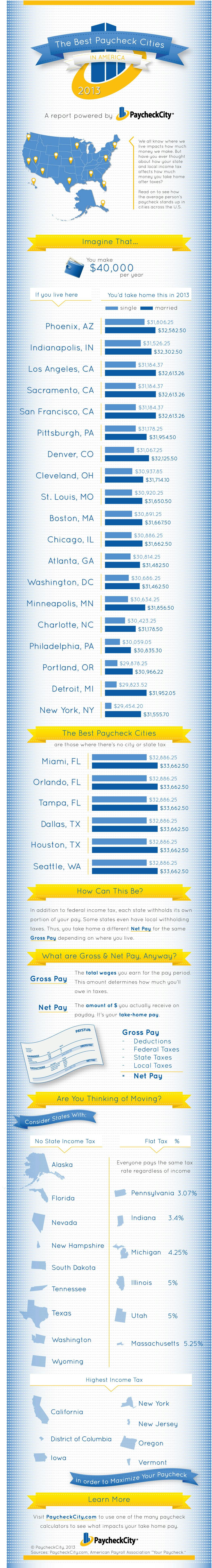

Symmetry Software has announced the top cities in America for take-home pay in an infographic available on PaycheckCity.com to help individuals find where they can get the most out of their paychecks. We all know that where we live impacts how much money we make in our gross pay, but few stop to consider that state and city payroll withholding taxes impact the amount of money we take home in our paychecks as our net pay. With tax season behind us, Symmetry's PaycheckCity.com is releasing the top cities for take home pay so that folks can determine where they can get the most out of their paychecks.

Symmetry Software has announced the top cities in America for take-home pay in an infographic available on PaycheckCity.com to help individuals find where they can get the most out of their paychecks. We all know that where we live impacts how much money we make in our gross pay, but few stop to consider that state and city payroll withholding taxes impact the amount of money we take home in our paychecks as our net pay. With tax season behind us, Symmetry's PaycheckCity.com is releasing the top cities for take home pay so that folks can determine where they can get the most out of their paychecks. Considering two different scenarios, PaycheckCity examines the difference in annual take home pay for cities across the country in the infographic.

The full version of the infographic available on PaycheckCity.com details the take-home pay for individuals in the following scenarios:

The infographic walks the viewer through the cities where they can maximize their paycheck based on the state and city tax codes. The best Paycheck Cities end up being where there is no city or state tax. The infographic further details helpful personal paycheck management information such as an explanation of the difference between gross and net pay, and a breakdown of how net pay is calculated. Finally, for those individuals who are inspired to move based on their city's taxes, the infographic displays states with no state income tax or a flat tax, as well as displays the seven states with the highest income taxes. The infographic isn't the only place to find out this helpful information. Tom Reahard, CEO of Symmetry Software, states, 'With PaycheckCity's online calculators, individuals can see for themselves what cities will give them the best take home pay.'

See what cities rank the best for take home pay with PaycheckCity's infographic.

Methodology: All calculations were done on PaycheckCity.com. Annual salary was set at $40,000 for all scenarios. Federal and state allowances for single were set at 1 and for married were set at 2. The highest income tax states represent the 7 states whose highest income tax brackets have rates greater than 8%. Important Note on Infographic: The information on this infographic is provided by Symmetry Software and is designed to provide general guidance and estimates. This information should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data. Neither this infographic nor the providers and affiliates thereof are providing tax or legal advice. You should refer to a professional adviser or accountant regarding any specific requirements or concerns.

The information on this infographic is provided by Symmetry Software and is designed to provide general guidance and estimates. This information should not be relied upon for accuracy, such as to calculate exact taxes, payroll or other financial data. Neither this infographic nor the providers and affiliates thereof are providing tax or legal advice. You should refer to a professional adviser or accountant regarding any specific requirements or concerns.

Tax Day is on Monday, Apr 15, 2024. Not ready to file? Submit an electronic request to the IRS for an extension ASAP!

IRS has updated tax brackets for 2024. See how this affects your first paycheck this year!

Check out the updated 2024 Federal benefit limits for 401(k), HSA, and simple IRA, and more. Stay informed and plan your finances with confidence!